Tax Exemption on investment, dividend income & redemption proceeds.

Chance to earn higher returns on funds invested in equity market.

Better Liquidity with a 3 year

lock-in period.

*INR 70,000 Invested every year for the last 15 years

ELSS - INR. 57.8 Lakh

PPF - INR 31.9 Lakh

ELSS could reduce the risks associated with investments in the long term and diversifies Deepak’s funds for added safety.

*Proxied by (CRISIL - AMFI ELSS Fund Performance Index). Data for the period of 01/06/2001 to 31/03/2016. Source - Crisil, www.epfindia.gov.in

Deepak's financial advisor suggested that he invest through a Systematic Investment Plan (SIP) in ELSS with small amounts at regular intervals, instead of putting in a large lump sum at the year end. The benefits of SIPs:

Small periodic diversified investments to average the cost

Smaller monthly

cash outflow

Opportunity to earn returns

from the start of the year

Savings: Deepak will benefit from the tax savings of ELSS.

Goal based investing: Deepak can use ELSS for long term investing – whether retirement, house or children's education!

Deepak educates his friends about ELSS and helps them choose the wise option over their auto mode PPF allocation.

Are you like Deepak’s friends? Do you invest INR 1.5 Lakhs of your hard earned money into PPFs without a thought? Think again! Take your 80C investment beyond the narrow purpose of tax-savings.

Protip! You can redeem INR 1.5 Lakhs from an ELSS after 3 years and reinvest the same to earn tax benefit for that year!

DSP BlackRock & HDFC Securities have joined forces to bring you ELSS plans to suit your needs. Both are globally respected names and have a proven pedigree. So don’t just save a penny, click on the “Invest Now” button and get a chance to earn a penny on top of the penny you saved.

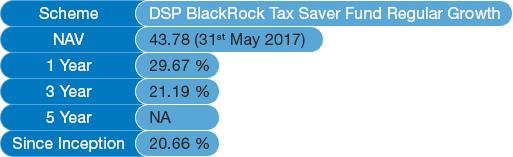

Less than 1 year Absolute returns, Greater than or Equal to 1 year Compound Annualized returns.

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

This scheme is suitable for investors who are seeking:

Click here To view performance in SEBI prescribed format.

The returns mentioned is as of November 30, 2016.

Investors should consult their financial / tax advisors if in doubt about whether the product is suitable for them.